Citi: $3,000 by Next Year!

Spot gold prices have hit new highs in recent days, with prices breaking through $2,580 per ounce in early trading on Friday, and New York futures gold surpassing $2,600 per ounce, both setting historical records.

The performance of spot gold for the year is expected to be the best since 2020, with a year-to-date increase of over 24%.

Citigroup analysts suggest that, driven by the monetary easing policies of major central banks and the tense situation of the U.S. presidential election, gold prices could reach $3,000 next year.

The surge in gold prices this year is primarily attributed to the increased demand from global central banks, which is particularly evident in the increasingly complex geopolitical and financial environment.

A survey conducted by the World Gold Council in April 2024 found that 29% of central bank respondents intended to increase their gold reserves within the next 12 months.

Aakash Doshi, Head of North American Commodities at Citi Research, stated on Friday that gold prices could reach $3,000 per ounce by mid-2025 and potentially $2,600 per ounce by the end of 2024, driven by U.S. interest rate cuts, strong ETF demand, and off-exchange physical demand.

Advertisement

Last week, the World Gold Council reported that global physical gold-backed ETFs saw inflows for the fourth consecutive month in August.

Peter A.

Grant, Vice President and Senior Metal Strategist at Zaner Metals, indicated that if upcoming data suggests growth risks and a weak labor market, the possibility of a 50 basis point rate cut in November or December would increase, providing a greater impetus to gold and accelerating the timeline for reaching $3,000.

Currently, major central banks have fully embarked on interest rate cuts, with the European Central Bank cutting rates by 25 basis points for the second time this year on Thursday.

Macquarie Bank in Australia raised its gold price forecast this week, now expecting an average cyclical peak price of $2,600 per ounce in the first quarter of next year, with the potential for a short-term spike to $3,000 per ounce.

Macquarie analysts stated, "Although the challenging fiscal outlook in developed markets is structurally positive for gold, many favorable factors have already been priced in, and cyclical resistance may emerge later next year."

There is also an analysis that the upcoming U.S. presidential election could drive gold prices higher, as potential market volatility may drive investors towards safe-haven gold.

Daniel Pavilonis, Senior Market Strategist at RJO Futures, said that reaching a gold price target of $3,000 per ounce is possible, adding that this scenario could be driven by political turmoil following the election.

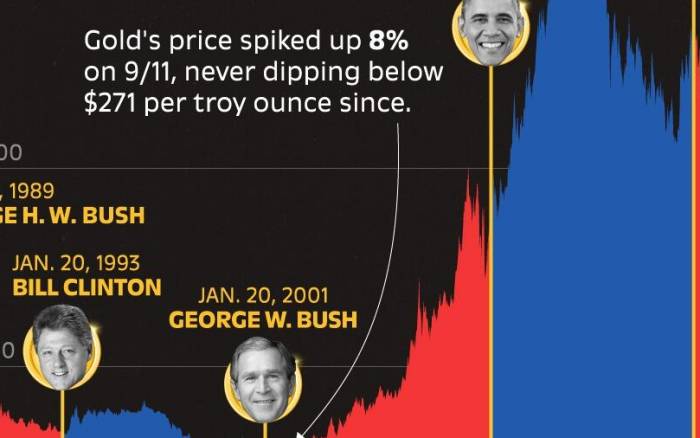

Data shows that gold prices have soared during the terms of recent U.S. presidents, starting from the time the new president takes office.

Historically, gold has been seen as a safe-haven asset during periods of geopolitical uncertainty and economic instability.

Although gold prices rose by more than 50% during President Trump's term and by 37% during President Biden's term, neither of these increases can match the Bush era, when gold prices increased by 215% between 2001 and 2009, the largest increase during a U.S. presidential term since 1989.

During Bush's term, gold prices experienced a bull market due to the 9/11 attacks and the subsequent geopolitical instability.

Analysts believe that if the 2008 global financial crisis had not occurred, this bull market could have been even more significant.

However, in 2008, due to fears of deflation and a flight to the dollar as a safe haven, gold prices fell by 30% from peak to trough.

Therefore, events like the 9/11 attacks, the COVID-19 pandemic, and the Russia-Ukraine conflict have all driven significant increases in gold prices, as investors seek stability during turbulent times.

Leave A Comment