A-Shares May Soar! Holiday Boosts HK Stocks, Yuan

The three-day holiday in Mainland China coincides with two normal working and trading days overseas, during which Chinese assets have clearly been sought after by foreign capital.

The A-share market may welcome opportunities after the holiday.

The FTSE China A50 has been rising continuously in the two trading days from Monday to Tuesday this week, with a 0.41% increase on Monday and a 0.51% increase on Tuesday, indicating that overseas funds are positioning in Chinese assets by buying A50 index futures.

The Hong Kong stock market might show a more pronounced performance.

On Monday, the Hang Seng Index rose by 0.31%, and the increase on Tuesday reached 1.37%.

The Hang Seng Technology Index also rose continuously in the last two trading days, with increases of 0.51% and 1.12% respectively.

It should be noted that the rise in Hong Kong stocks does not reflect a general rise in overseas stock markets; on Tuesday, the Nikkei 225 index fell by 1.03%.

Meanwhile, among the three major U.S. indices that closed in the early hours of Tuesday, the Nasdaq index also fell by 0.52%, while the gains of the other two indices were not significant.

Advertisement

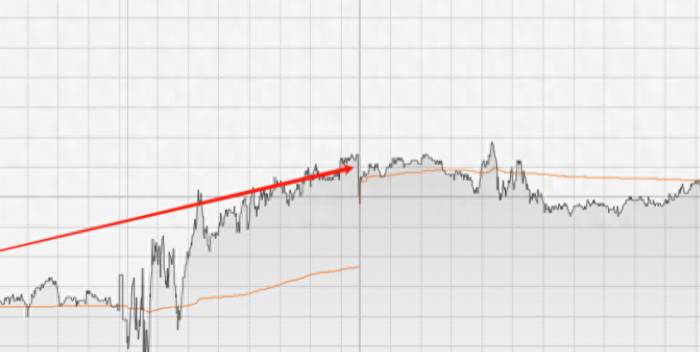

A few days' trend does not indicate much, but a long-term trend seems to be forming.

Ultimately, it depends on the interest rate cut decision that the Federal Reserve is about to make, as well as the trend reflected by the recent economic data in the United States.

Several recent U.S. economic data points indicate that the U.S. economy is not as good as imagined.

Although inflation has been initially controlled, the employment market data has declined faster than inflation.

Moreover, even though the U.S. has not cut interest rates yet, the devaluation speed of the U.S. dollar is accelerating.

Even if the Canadian dollar and the euro have cut interest rates, the U.S. dollar has not been boosted.

This would be unreasonable in the past because the most direct indicator of the U.S. dollar's trend is the U.S. dollar index, which is pegged to six major international currencies, including the euro and the Canadian dollar.

Normally, if the Federal Reserve's interest rates remain unchanged, the interest rate cuts for the Canadian dollar and the euro would promote the devaluation of these two currencies and simultaneously help to push up the U.S. dollar's exchange rate.

But now the problem is that the U.S. dollar has not appreciated but depreciated, getting closer to the 100 mark.

Now, the market's prediction that the Federal Reserve will cut interest rates by 50 basis points has reached 62%, which will further depreciate the U.S. dollar.

On the other hand, U.S. officials are not as optimistic as before, and several lawmakers believe that the U.S. economy is very likely to enter a recession.

Therefore, a few lawmakers led by Senator Elizabeth Warren have sent an open letter to the Federal Reserve, asking Powell to raise interest rates more aggressively to reduce economic risks.

That is to say, cutting interest rates by 75 basis points is also within the scope of consideration.

Meanwhile, in recent days, the offshore exchange rate of the Chinese yuan has already broken through 7.10, which also indicates that the demand for buying the Chinese yuan is getting stronger.

As more funds may flow out of the United States, some of which will flow into China, the strength of buying Chinese assets will be further strengthened in the coming period.

The A-share market, which has been adjusting for so long, is very likely to usher in a wave of significant gains.

Leave A Comment