Fed's $35.35T Move Spurs Biggest US Debt Selloff

On Manhattan's Sixth Avenue in New York, the numbers on the "National Debt Clock" are constantly changing, with the only constant being that the numbers keep rising and show no signs of stopping.

Currently, the clock has reached a staggering $35.35 trillion, breaking through the $35 trillion mark at the end of July this year, and setting a new high in September.

In less than two months, the U.S. debt has increased by over $350 billion.

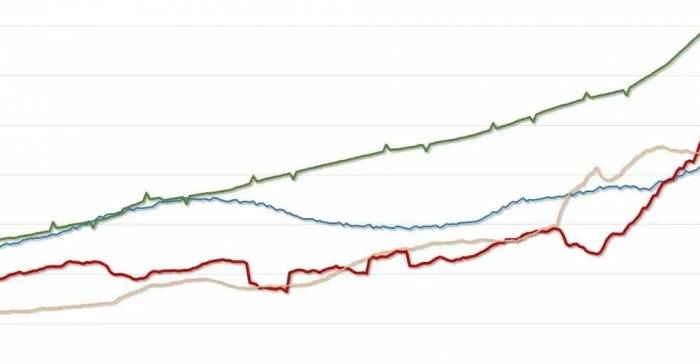

Looking at the data, over the past seven years, the U.S. debt has increased by $15.2 trillion, marking a significant period of rapid expansion.

According to predictions by U.S. institutions, it is expected that by 2035, the U.S. debt will surpass the $50 trillion mark.

With the United States maintaining high interest rates, the larger the debt, the higher the interest payments required.

If the Federal Reserve continues to refuse to lower interest rates, by the end of 2024, the interest payments on U.S. debt will reach a staggering $1.6 trillion.

This means that interest payments on U.S. debt will become the largest expenditure item in the United States, surpassing social security spending, healthcare spending, and military spending.

Advertisement

Even with a September interest rate cut, the interest on the national debt by the end of the year will still be as high as $1.5 trillion, exceeding other government expenditures.

Not only is the interest expenditure on national debt soaring, but the fiscal deficit has also reached a new high.

In the fiscal year of 2023, the U.S. fiscal deficit was $1.7 trillion, with net interest payments at only $650 billion.

However, the fiscal year 2024 has not yet ended, and the fiscal deficit has already reached $1.9 trillion, with net interest payments breaking through $84 billion, a surge of 30%.

The U.S. fiscal deficit will continue to rise, and the root cause is the alternating power of the two major parties, the Democrats and the Republicans.

In order to win elections, both parties are willing to spend more money to pave the way for their own victories, so ultimately no one is willing to constrain debt, and the deficit will only get higher and higher.

Even if the United States does not face a fiscal crisis in the short term, the power to coin money is in the hands of the Federal Reserve, which will compensate for fiscal gaps through the expansion of its balance sheet, so a flood of money in the future is a high probability event, after all, this can also dilute the U.S. debt.

However, the Federal Reserve has not yet lowered interest rates and is still reducing its balance sheet, but a clear change recently is that the pace of balance sheet reduction has slowed down.

Data shows that from March to June this year, the Federal Reserve's balance sheet decreased from $7.5 trillion to $7.2 trillion, with an average monthly reduction of over $90 billion, while from June to September this year, the Federal Reserve's balance sheet decreased to $7.1 trillion, with an average monthly reduction of less than $50 billion.

The Federal Reserve had previously stated that it would slow down the reduction of its balance sheet after June, which is actually preparing for future interest rate cuts.

Looking at the balance sheet published by the Federal Reserve, in the first week of September, the Federal Reserve's assets shrank, reverse repos decreased, and fiscal deposits increased, together releasing liquidity of over $30 billion.

The Federal Reserve itself has stepped in, no longer massively reducing its holdings of U.S. debt as before.

As early as June 2022, the Federal Reserve's asset size approached $9 trillion, with holdings of U.S. debt at $5.77 trillion, and by September 2024, the Federal Reserve's balance sheet size has decreased to $7.1 trillion, with holdings of U.S. debt decreasing to $4.38 trillion.

Therefore, over the past two years, the Federal Reserve has cumulatively sold nearly $1.4 trillion in U.S. debt, becoming the largest seller of U.S. debt, not China or Japan.

The total amount of U.S. debt sold by China and Japan over the past two years is far less than $1 trillion.

This is the balance sheet reduction carried out by the Federal Reserve over the past two years to cooperate with interest rate hikes, by selling the U.S. debt it holds to exchange for dollars in the market, tightening liquidity, and suppressing inflation.

Now that the Federal Reserve has started to slow down its balance sheet reduction, it indicates that the liquidity crisis within the United States is rising, especially as the U.S. banking industry holds a large amount of U.S. debt with significant unrealized losses, urgently needing to release liquidity, and also eagerly hoping for the Federal Reserve to lower interest rates.

Whether it is a September interest rate cut, an end-of-year cut, or a cut next year, at the beginning of the U.S. dollar interest rate cut cycle, the Federal Reserve will not quickly expand its balance sheet, but will continue to slow down the pace of balance sheet reduction.

The day when the Federal Reserve starts to expand its balance sheet will mean that a flood of global currency is coming, and the era of great inflation has arrived.

Unless the U.S. economy experiences a severe recession and the financial system collapses, the Federal Reserve will start to significantly expand its balance sheet, just like in 2020 when the U.S. stock market experienced several circuit breakers due to the epidemic, the economy was severely impacted, and the Federal Reserve quickly expanded its balance sheet, directly reducing interest rates to zero, starting unlimited quantitative easing, and significantly purchasing U.S. debt.

Now the world is waiting for the Federal Reserve to "release water," and Jewish capital is thinking about how to shift the huge debt of $35 trillion to the world, making the world pay the bill.

The closer it gets to the moment of interest rate cuts, the more restless the blue planet becomes, with rising risks, but this does not mean that Jewish capital will get what it wants.

This round of dollar tide has encountered "Waterloo," which is a major blow to the dollar hegemony.

Times are changing, and the situation is also changing.

Once this harvest fails, it will be even more difficult to harvest the next time.

Leave A Comment