Report Sparks 50bp Rate Cut Hopes, Small Caps Thrive, Gold Hits New High

Only a few days remain until the Federal Reserve announces the resolution of its monetary policy meeting next Wednesday, and financial markets are once again warming up to the expectation that the Fed will significantly cut interest rates.

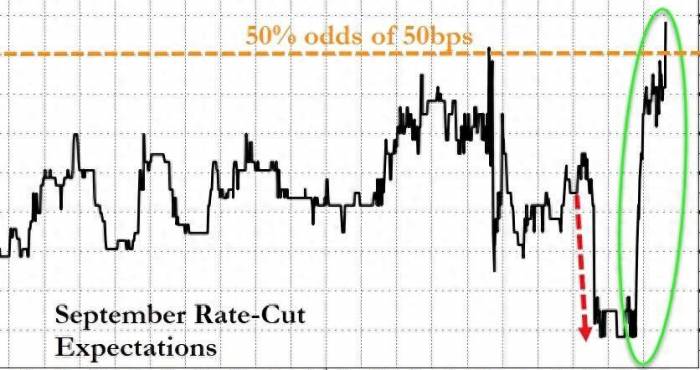

On Friday this week, bond market traders estimated that the probability of the Fed cutting rates by 50 basis points reached 40%, far exceeding the 4% earlier in the week.

Futures linked to the Fed's policy rate indicated that traders expected the probability of a 50 basis point rate cut by the Fed to rise to about 47%, almost a fifty-fifty chance, while the probability estimated on Thursday was only about 28%.

Some media have pointed out that the core CPI growth in the United States for August, which was released on Wednesday this week, was stronger than expected, and the U.S. labor market remains relatively strong.

These signs led traders to almost completely disbelieve that the Fed would make a significant rate cut.

The reason for their significant shift in stance on Friday stems from a report published by The Wall Street Journal on Thursday, which stated that Fed policymakers are considering whether to make a conventional cut of 25 basis points or a more substantial cut of 50 basis points.

Advertisement

The aforementioned report is the analysis article by Nick Timiraos, previously mentioned by Wall Street Journal as the "new Fed mouthpiece."

The article stated that the recently released data has been "mixed," with neither inflation nor employment data being able to "seal the deal" on the extent of the rate cut.

Starting with a cut of 25 basis points is the path of least resistance, which can avoid the market panic caused by a significant rate cut and the challenge of explaining a substantial rate cut before the election.

However, if the Fed expects a total of 100 basis points of rate cuts this year, starting with a 25 basis point cut might be a bit awkward: since a more substantial rate cut is expected later in the year, why not take this action sooner?

Other media also pointed out that the speech by Bill Dudley, the former "number three" at the Fed and former chairman of the New York Fed, at a forum in Singapore on Friday this week also fueled expectations of a significant rate cut.

Dudley said, "I think there are good reasons for a 50 basis point rate cut, whether they (the Fed) cut or not."

Dudley said that the current interest rates are 150 to 200 basis points higher than the so-called neutral rate that neither restricts nor eases the economy, "so the question is, 'Why don't you start now?'"

The rekindled expectation of a 50 basis point rate cut stimulated the rotation in the U.S. stock market on Friday this week, with investors shifting to stocks that would benefit most from the Fed's monetary easing.

A clear sign of rotation is that small-cap stocks outperformed large-cap stocks.

When the S&P and Nasdaq hit their daily highs during the trading day, the gains did not exceed 0.9%, while the Dow hit its daily high with a rise of nearly 1.1%.

In contrast, the small-cap index dominated by value stocks, the Russell 2000, rose more than 2% at midday and exceeded 2.5% when hitting its daily high.

Jonathan Krinsky, Managing Director and Chief Market Technician at BTIG, commented, "The biggest news in the past 24 hours is that the possibility of a 50 basis point rate cut by the Fed next week has changed.

Small-cap stocks offer a better risk/reward in the short term, and we believe that blue-chip tech stocks may take a breather again, although they will definitely participate if the S&P 500 index sets a new high."

Bryan Whalen, Chief Investment Officer at TCW Group, said, "If the Fed cuts rates by 25 basis points next week, they will be behind the curve."

He stated that if the U.S. retail sales data, which will be released before the end of next week's Fed meeting, are unexpectedly weak, the momentum for a 50 basis point rate cut next week will increase.

"If they only cut rates by 25 basis points, it will be more favorable for the bond market, because it means that the Fed will have to take more aggressive measures in the future."

The warming up of expectations for a significant rate cut led to a general decline in U.S. Treasury yields on Friday, and the dollar weakened.

The 2-year U.S. Treasury yield, which is more sensitive to interest rate prospects, once fell below 3.57% during the trading day, approaching the intraday low set on Wednesday this week since September 2022.

The U.S. dollar index once fell below 100.90 before the U.S. stock market opened, and after repeatedly hitting a new high for more than a week on Wednesday and Thursday, it fell to a week-low on Friday.

The Japanese yen subsequently surged, and the U.S. dollar against the Japanese yen fell to 140.29 during the trading day, hitting a low since the end of December last year, with a drop of more than 1%.

The rate cut is good for gold, and the gold price hit a record high for the second consecutive day.

When the U.S. stock market hit a record high during the trading day, the spot gold price rose above 2,586 U.S. dollars, with an increase of more than 1% during the day, and the New York gold price broke through 2,610 U.S. dollars, with an increase of 1.3% during the day.

Leave A Comment