Nasdaq Down, Dow, Gold Peak, Yields Low, Commodities Up

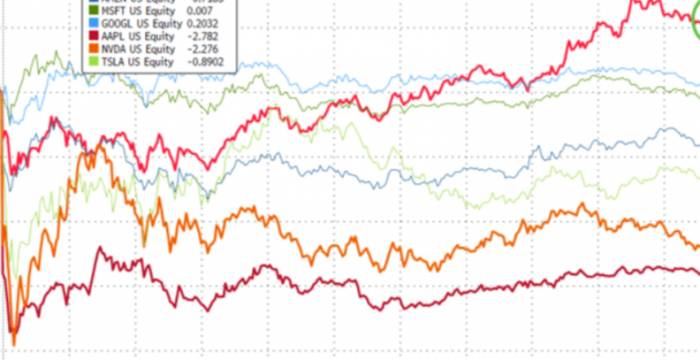

On the eve of the Federal Reserve FOMC meeting, Nvidia's stock closed down 1.95%, and Apple saw a decline of approximately 12.7% in the pre-order sales volume of the iPhone 16 series during its first weekend, compared to the previous year.

This weak demand has raised concerns among investors, leading to a general decline in stocks of technology companies in the Apple supply chain.

Lingyun Semiconductor once fell more than 10%, dragging the Nasdaq index down nearly 1.5% at one point, ending its five-day winning streak.

The rotation in the US stock market continues as investors sell technology stocks and buy small-cap and blue-chip stocks.

The financial and energy sectors are leading the gains.

In the later part of last week and over the weekend, several media opinion pieces and strong support from former Federal Reserve officials have ignited market expectations for a significant rate cut.

Currently, the market expects the possibility of a 50 basis point rate cut by the Federal Reserve in September to have increased from 50% to 67%.

Advertisement

This has led to a weakening of the US dollar, with short-term US Treasury yields hitting a two-year low.

However, after the New York Fed released manufacturing data that exceeded expectations, the yields flattened out.

Influenced by strong new orders and shipment data, the US September New York Fed Manufacturing Index stood at 11.5, the highest level since April 2022.

After falling nearly 1.5% at the beginning of the trading session, the Nasdaq index closed down 0.52%, while the Dow Jones Industrial Average once rose more than 0.8% or 340 points, closing up 0.55% to set a new record high for both intraday and closing prices.

The chip index, dragged down by the general decline in the Apple supply chain, fell nearly 2.5% before closing down 1.41%.

Among Apple's "Seven Sisters," the worst performer was Lingyun Semiconductor, which fell nearly 10.5% before closing down 5.97%, Qorvo fell 6.68%, and Nvidia fell more than 3.9% before cutting its losses in half: Most of the industry ETFs in the US stock market closed higher.

Financial industry ETFs, regional bank ETFs, banking industry ETFs, and energy industry ETFs each rose by more than 1%, while utility ETFs, healthcare industry ETFs, and internet stock index ETFs each rose by at least 0.5%.

However, the semiconductor ETF fell more than 1%, and the global technology stock ETF also fell by more than 0.5%.

Chinese concept stocks fluctuated.

The Nasdaq Golden Dragon China Index closed down 0.58%.

Among ETFs, the China Technology Index ETF (CQQQ) closed up 0.94%.

The China Internet Index ETF (KWEB) closed up 0.51%.

On the eve of the interest rate meetings of the Federal Reserve and the Bank of England this week, European stocks opened low and continued to decline: The pan-European Stoxx 600 index closed down 0.16%, ending a three-day winning streak, at 515.11 points.

The technology sector performed poorly, falling 1.26%, with Infineon, a chip stock in the "Apple supply chain," closing down 2.60%, and ams Osram AG down 4.58%.

Among other constituent stocks, Volkswagen closed down 1.52%, with Jefferies analysts stating that Volkswagen is considering laying off 15,000 people due to factory closures.

Deutsche Bank's European stocks closed down 0.21%, while UniCredit closed up 0.53%, with reports that Deutsche Bank is considering blocking UniCredit's acquisition of Commerzbank.

The German stock index closed down 0.35%.

The French stock index closed down 0.21%.

The Italian stock index rose by less than 0.01%.

The Spanish stock index rose by 0.35%.

The British stock index rose by 0.06%, and the Dutch AEX index closed down 0.43%.

On the eve of the Federal Reserve policy meeting, the two-year and 10-year US Treasury yields both fell by more than 2 basis points: On the news front, BlackRock downgraded the rating of US short-term government bonds from "overweight" to "underweight," believing that the market's expectations for a Federal Reserve rate cut are too aggressive.

European bond yields continued their downward trend: The benchmark 10-year German government bond yield fell by 2.6 basis points.

The two-year German government bond yield fell by 2.8 basis points.

The French 10-year government bond yield fell by 1.1 basis points, and the Italian 10-year government bond yield fell by 3.2 basis points.

The British 10-year government bond yield fell by 0.9 basis points, and the two-year British government bond yield fell by 1.2 basis points.

With expectations of a 50 basis point rate cut heating up, the US dollar index DXY fell by nearly 0.5%, approaching the lowest in 52 weeks, the Japanese yen broke through the 140 threshold to its highest in over a year, the offshore renminbi once rose by more than 120 points, breaking through 7.09 yuan, and Bitcoin fell below the 58,000 US dollar mark: Sources said that there has been no recent progress in the Gaza ceasefire agreement, and coupled with the impact of the hurricane in the Gulf of Mexico, US oil prices closed up more than 2%, returning to the 70 US dollar mark, and Brent oil rose by about 1.6%, reaching the highest in over a week: On the eve of the Federal Reserve FOMC meeting, the rotation in the US stock market continues, with investors selling technology stocks and buying blue-chip stocks.

The Nasdaq index fell nearly 1.5% at the beginning of the trading session before narrowing its losses, while the Dow Jones Industrial Average once rose more than 0.8% or 340 points to set a new intraday high, and the chip index once fell nearly 2.5%, with Nvidia falling more than 3.9% before cutting its losses in half: [The following content was updated before 21:50] With the Federal Reserve rate cut imminent, market expectations for a 50 basis point rate cut by the Federal Reserve have once again heated up, with the futures market showing that the possibility of a significant rate cut by the Federal Reserve is 59%.

Today, the Republican presidential candidate Trump was suspected of being assassinated again, increasing market volatility and raising safe-haven sentiment, with spot gold prices continuing to rise, and the US dollar falling to a new low against the Japanese yen since July last year.

US stock futures opened with Intel's US stock rising nearly 7% before the market.

Reports say that the company has finally met the qualifications to manufacture semiconductor components for the Pentagon and is expected to receive a contract worth up to 3.5 billion US dollars.

Trump Media Technology Group's US stock once rose nearly 9% before the market.

[The following content was updated at 16:20] The Hang Seng Index closed up 0.31%, and the Hang Seng Technology Index closed up 0.51%.

New World Development rose nearly 5%, Kuaishou rose more than 4.5%, NIO Inc. rose nearly 4%, and Bilibili fell more than 5%.

Gold stocks rose, with China Gold International and Shandong Gold both rising more than 4%.

[13:35 update] Spot silver rose 1.00% during the day, currently at 31.01 US dollars per ounce.

COMEX silver futures rose more than 1.00% during the day, currently at 31.39 US dollars per ounce.

The Indian stock market rose to a record high, with India's largest annual IPO, Bajaj Housing Finance, soaring 130% on its first day of listing.

The benchmark index NSE Nifty 50 and the S&P BSE Sensex index both rose by about 0.3%, setting a new historical high.

[11:33 update] Spot gold continued to rise, setting a new historical high, once touching 2589.07 US dollars per ounce, rising nearly 0.4% during the day.

The US dollar fell to 140.17 against the Japanese yen, falling 0.46% during the day, setting a new low since July last year.

[10:58 update] Hong Kong-listed auto stocks showed divergent trends during the day, with NIO Inc. rising nearly 4%; Evergrande Auto fell more than 10%, and Zero Run Auto fell more than 3.5%.

[10:26 update] Affected by Typhoon Bebinca, most flights at Shanghai's two major airports were canceled.

Hong Kong-listed airline stocks fell during the day, with China Eastern Airlines falling nearly 5%, China Southern Airlines falling more than 3%, and Air China and Beijing Capital Airport both falling more than 2%.

Gold stocks rose, with Zhaojin Mining Industry rising more than 2%, and China Silver Group and Shandong Gold both rising more than 3%.

Real estate stocks continued to fall, with Oceanwide Holdings falling more than 9%, Evergrande falling nearly 6%, and Agile Group falling 4%.

[9:38 update] The Hang Seng Index fell more than 1% during the day, and the Hang Seng Technology Index fell 1.4%; Nongfu Spring fell more than 4%, JD Health fell nearly 4%, and NetEase fell more than 3.5%.

[9:30 update] The Hang Seng Index opened down 0.67%, and the Hang Seng Technology Index opened down 0.72%.

Leave A Comment